July 7, 2025

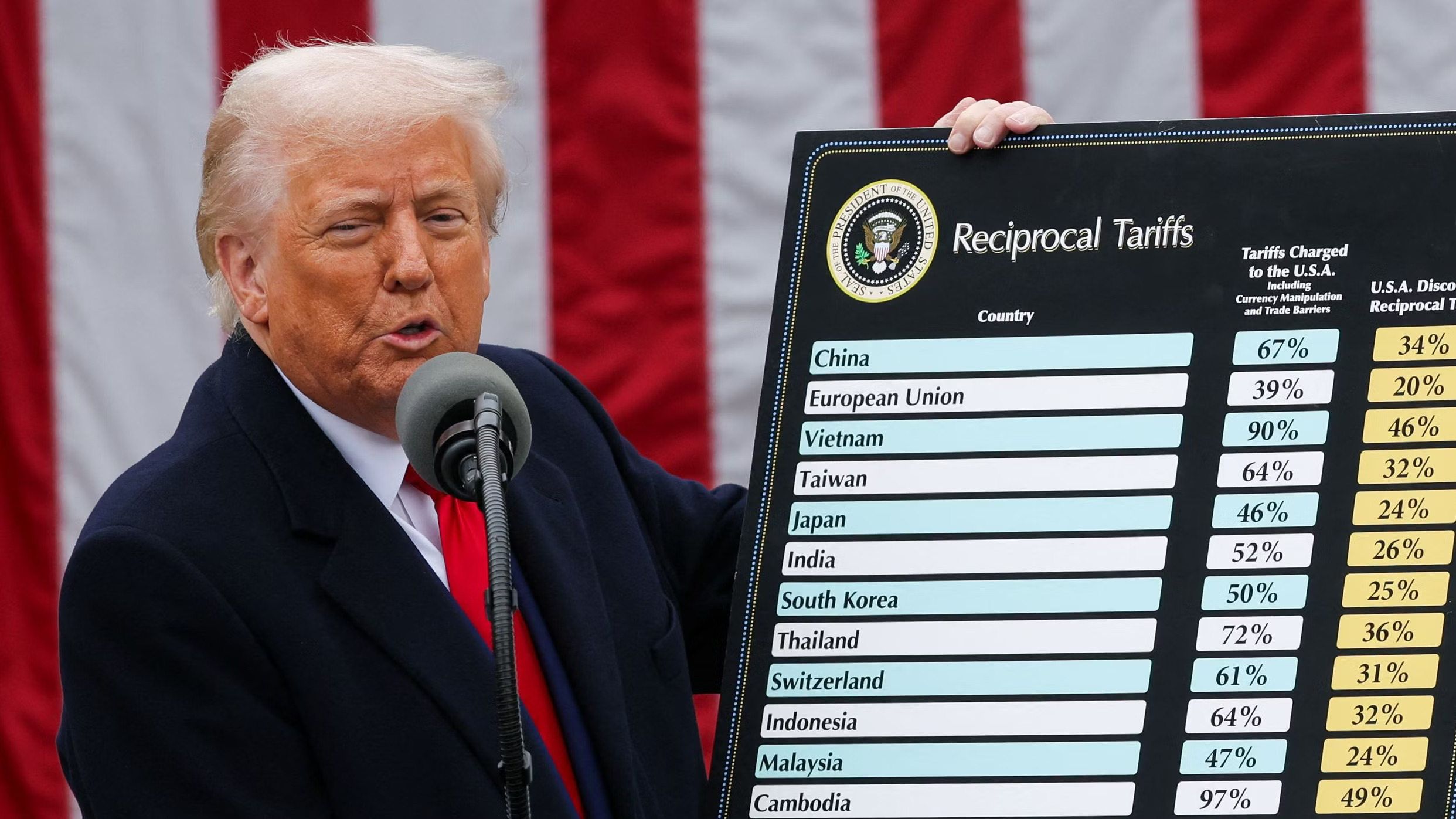

Global investors are navigating a pivotal moment this week as U.S. Treasury Secretary Scott Bessent confirmed that Washington is close to finalizing several trade agreements just days ahead of a looming July 9 deadline, which marks the end of a 90-day tariff truce. These agreements, reportedly involving nations such as India, Thailand, and several EU partners could determine whether tariffs snap back to punishing levels of 50% or higher for non-compliant countries on August 1. As reports indicate, Thailand and others are scrambling to meet U.S. terms before the clock runs out (Reuters, 2025a).

While these negotiations unfold, the U.S. dollar remains near multi-year lows. The Dollar Index hovered at 96.97 as investors cautiously await final outcomes, balancing optimism over potential deals with fatigue from prolonged trade uncertainty. With major decisions pending, most investors appear to have already priced in a range of scenarios, leading to a surprising calm before the storm (Reuters, 2025b).

Oil markets saw renewed movement as OPEC+ announced it would increase production by 548,000 barrels per day starting in August, well above expectations. The move caused Brent crude to slip 1% to around $67.63 per barrel, though analysts say the drop is more a reflection of temporary supply confidence than a shift in long-term fundamentals (Reuters, 2025c).

Remarkably, markets seem almost desensitized to tariff headlines. Despite a 14% correction earlier this year tied to tariff shocks, indexes have since bounced back by roughly 24%. This has led to what some analysts call a “benumbed and blasé” investor environment ahead of what Trump calls “Liberation Day”, the formal reimplementation of tariffs in August (Reuters, 2025d).

Monetary policy remains a key wildcard. Atlanta Fed President Raphael Bostic said last week that the economic effects of tariffs and Trump’s sweeping $3 trillion spending plan may take over a year to fully emerge. He expressed caution about lowering interest rates too soon but still anticipates at least one cut before year-end, likely by September if inflation continues easing. His view reflects a growing divide at the Fed between those urging proactive easing and those concerned about overheating (Reuters, 2025e; Reuters, 2025f).

As we enter a defining week, markets are delicately balanced between optimism and anxiety. Whether investors continue to ride the rally, or get rattled by abrupt trade shifts or delayed monetary responses, depends heavily on what unfolds before the July 9 deadline.

References

Reuters. (2025a, July 6). US close to several trade deals, announcements expected in coming days, Bessent says. https://www.reuters.com/world/china/us-close-several-trade-deals-announcements-be-made-next-days-bessent-says-2025-07-06/

Reuters. (2025b, July 6). Dollar pinned near multi-year lows as Trump tariff deadline looms. https://www.reuters.com/world/africa/dollar-pinned-near-multi-year-lows-trump-tariff-deadline-looms-2025-07-06/

Reuters. (2025c, July 6). Oil slips 1% after OPEC+ accelerates output hikes. https://www.reuters.com/business/energy/oil-slips-1-after-opec-accelerates-output-hikes-2025-07-06/

Reuters. (2025d, July 6). Investors head into Trump tariff deadline benumbed and blasé. https://www.reuters.com/world/china/investors-head-into-trump-tariff-deadline-benumbed-blase-2025-07-06/

Reuters. (2025e, July 3). Fed’s Bostic: Adjustment to Trump policies could take a year or more. https://www.reuters.com/business/feds-bostic-adjustment-trump-policies-could-take-year-or-more-2025-07-03/

Reuters. (2025f, June 30). Fed’s Bostic still eyes one rate cut this year. https://www.reuters.com/business/feds-bostic-still-eyes-one-rate-cut-this-year-2025-06-30/