August 25, 2025

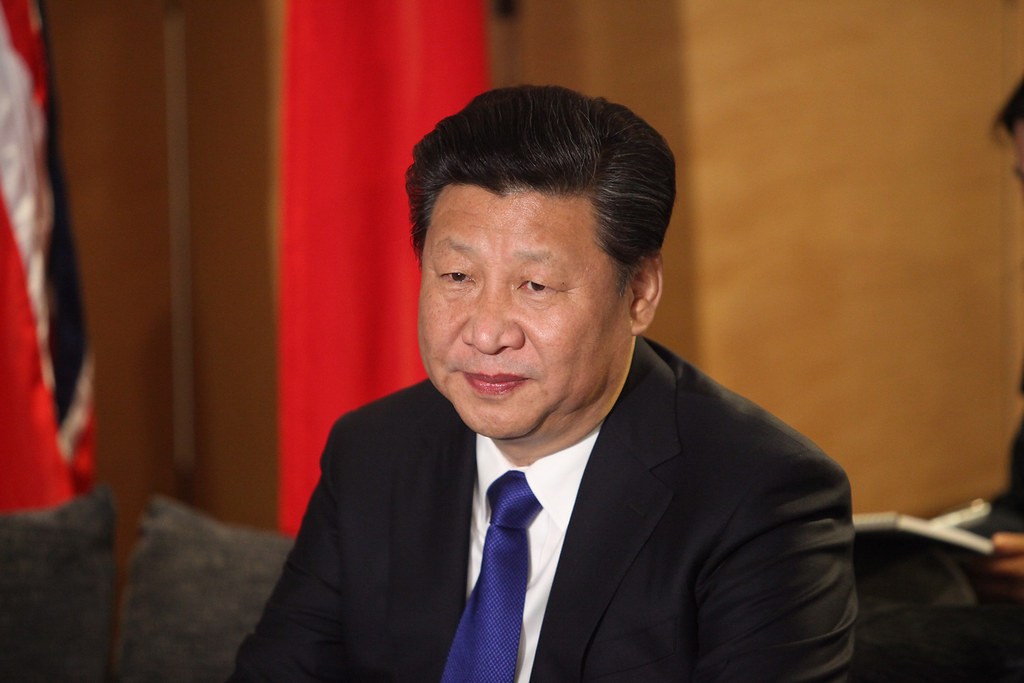

The economic and diplomatic landscape between the United States and ASEAN is entering a critical juncture, shaped by policy pivots in Washington, evolving central bank strategies in Southeast Asia, and the looming absence of Chinese leadership at a key summit. Reports from Reuters confirm that Chinese President Xi Jinping is likely to skip the October ASEAN summit, a signal that Beijing may be recalibrating its priorities at a time when Washington is courting the region with renewed vigor. For ASEAN, the symbolism could not be clearer: China’s disengagement risks leaving space for the United States to deepen economic and strategic ties, but the region must decide whether it wants to be a passive beneficiary of great power rivalry or an active architect of its own future.

Meanwhile, Southeast Asia’s largest economy is already making bold moves to stabilize growth. Bank Indonesia surprised markets last week by cutting its benchmark rate to 5.00%, the fifth reduction since September, aiming to support growth while maintaining a stable rupiah and managing inflation effectively. This comes on the back of better-than-expected growth, with Indonesia’s Q2 GDP expanding 5.12% year-on-year, beating expectations and strengthening Jakarta’s case that Southeast Asia can weather global volatility if it acts decisively. Analysts note that Governor Perry Warjiyo has left the door open for further easing, underscoring a proactive stance that contrasts sharply with the caution seen in other emerging markets. The signal to the region is unmissable: in a world where capital flows are shifting rapidly, confidence and adaptability matter as much as raw economic size.

On the U.S. side, the picture looks stronger than many anticipated. S&P Global’s August PMI data shows American business activity is picking up, with the composite index at 55.4 and manufacturing at 53.3, signaling expansion well above expectations. For ASEAN, this is a double-edged sword: a robust U.S. economy fuels demand for Southeast Asian exports, but it also strengthens the dollar, which could complicate capital flows and debt servicing in more vulnerable economies. This is where strategy becomes essential. As one East Asia Forum analysis emphasizes, ASEAN cannot simply ride the waves of U.S. or Chinese demand, it must double down on regional trade liberalization. Studies suggest that greater integration through agreements like RCEP and CPTPP could boost regional GDP by as much as 1.9%, while failing to act risks a 2.3% contraction if fragmentation persists. In other words, unity is not a luxury; it is survival.

The real test for ASEAN will come in the months ahead. The bloc faces a delicate balancing act: managing the optics of Xi’s absence, leveraging U.S. economic momentum, and ensuring its own domestic policies keep growth on track. But beyond the headlines, the deeper question remains whether ASEAN can transform itself from a reactive player to a proactive force in shaping global trade architecture. The stakes are high, and the costs of inaction are steep. For now, the world is watching not just Washington or Beijing, but Jakarta, Bangkok, and Hanoi, because the choices made in Southeast Asia will ripple far beyond its shores.

-

Reuters. (2025, August 22). China’s Xi likely to skip October ASEAN leaders summit. https://www.reuters.com/world/china/chinas-xi-likely-skip-october-asean-leaders-summit-sources-say-2025-08-22/

-

Reuters. (2025, August 20). Indonesia’s central bank surprises with rate cut, raises GDP outlook. https://www.reuters.com/world/asia-pacific/indonesias-central-bank-surprises-with-rate-cut-raises-gdp-outlook-2025-08-20/

-

Reuters. (2025, August 5). Indonesia Q2 GDP growth at 5.12% y/y, beats expectations. https://www.reuters.com/world/asia-pacific/indonesia-q2-gdp-growth-512-yy-beats-expectations-2025-08-05/

-

Reuters. (2025, August 21). US business activity picks up in August, factories lead the way. https://www.reuters.com/business/us-business-activity-picks-up-august-factories-lead-way-survey-says-2025-08-21/

-

East Asia Forum. (2025, August 25). Asia must double down on regional trade liberalisation to overcome the cost of Trump’s trade chaos. https://eastasiaforum.org/2025/08/25/asia-must-double-down-on-regional-trade-liberalisation-to-overcome-the-cost-of-trumps-trade-chaos/